Nigeria was recently declared a “country of particular concern” by President Donald Trump, who cited alleged threats to Christians in the country and publicly threatened possible U.S. military intervention to combat terrorism and protect religious minorities. This development is highly consequential for Nigeria, its global reputation, and the diaspora community.

Below is a concise, practical brief for the Nigerian diaspora – what happened, why it matters, and how the Diaspora can turn this moment into positive, strategic engagement by responding in ways that protect communities, increase leverage, advocacy, and engagement.

On October 31, 2025, President Trump announced that Nigeria would be added to the U.S. State Department’s “Countries of Particular Concern” list, citing claims that Christianity faces an “existential threat” due to attacks from radical Islamist groups. He further warned that if the Nigerian government failed to protect Christians, the U.S. could halt all aid and possibly mount swift military intervention, “guns-a-blazing,” against terrorist factions. He also ordered the Pentagon to “prepare for possible action” and said that U.S. troops or air strikes could be used to stop groups that are targeting Christians.

Nigeria’s Response

Nigeria’s government strongly rejected these claims, pointing out that violence affects all faiths, and that security challenges are not exclusive to any one religion. Some American and global observers debate the factual basis for Trump’s claims, with some stressing the need for nuanced discussion over simple narratives of religious persecution. However, there are also other voices – Christian groups, Nigerian citizens, some U.S legislators, etc that are strongly insisting that Christian genocide is occurring in Nigeria.

Key Points the Nigerian Diaspora Should Know

- Designating Nigeria as a “Country of Particular Concern” adds Nigeria to the watchlist under the International Religious Freedom Act. This creates diplomatic pressure and can result in more scrutiny, strained diplomatic relations, or even travel restrictions but does not automatically mean military action.

- Threats of military intervention raise the stakes for both U.S.-Nigeria relations and the Nigerian diaspora’s advocacy work.

- Many American and global observers debate the factual basis for Trump’s claims, with experts stressing the need for nuanced discussion over simple narratives of religious persecution. However, there are lot of voices – Christian groups, Nigerian citizens, some U.S legislators, etc that are strongly insisting that Christian genocide is occurring in Nigeria.

- President Trump publicly said he had asked the Pentagon to prepare options and stated that options could include “boots on the ground” or air strikes.

Why the Nigerian Diaspora should pay attention

- Policy cascades quickly: A CPC designation can change how bilateral aid, visas, and security cooperation are handled. That affects NGOs, businesses, students and health programs operating in Nigeria.

- Narrative & media framing matters: Global media coverage affects investment, remittances perceptions, and the credibility of local institutions. The story circulating abroad may influence political responses in host countries.

- Risk of escalation: Troubling rhetoric about “military action” raises the risk of diplomatic friction and could have security consequences if poorly managed.

How the Nigerian Diaspora Can Respond: Teachable Moments and Strategic Engagement

Turn Crisis into Strengthened Influence

- Invest in institutions: support independent media, legal aid, and local reconciliation programs so Nigerian institutions become more resilient and credible on the global stage.

Seize the Opportunity to Increase Advocacy

- Engage U.S. lawmakers and policymakers. Share lived experiences, affirming that the Nigerian diaspora is a bridge for understanding that can be leveraged to for the benefit of the host communites and Nigeria.

Target media outreach to challenge simplistic headlines, using op-eds, interviews, and social media to provide credible, factual accounts of the realities on the ground.

Build Leverage Through Unity

- Cultivate coalitions across faith groups, civil society, professional associations and business chambers to present unified asks and advocate for both U.S. support and Nigerian reform. Single community voices is easy to dismiss; a cross-sector coalition is harder to ignore.

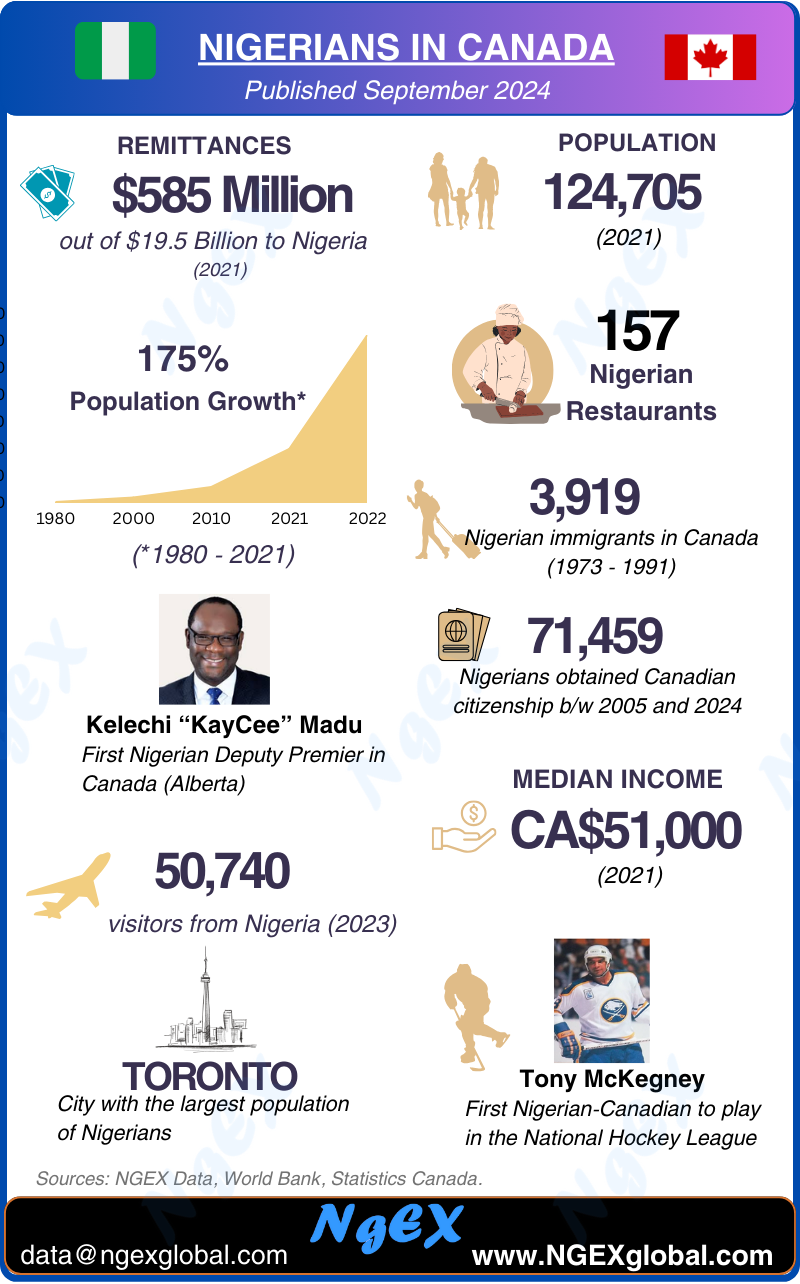

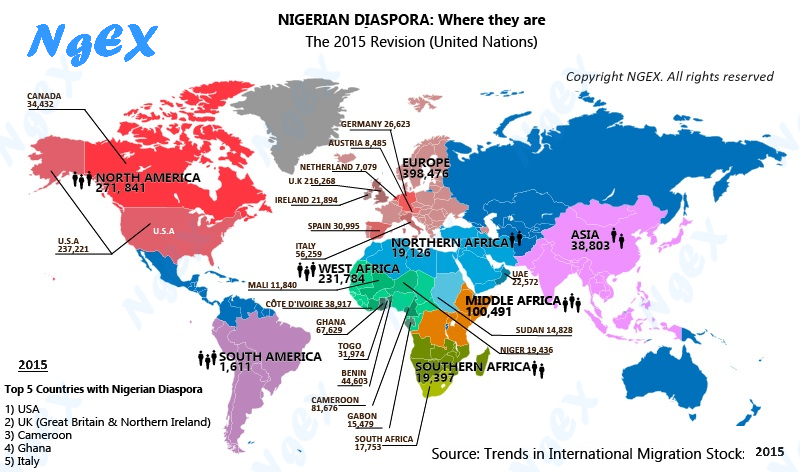

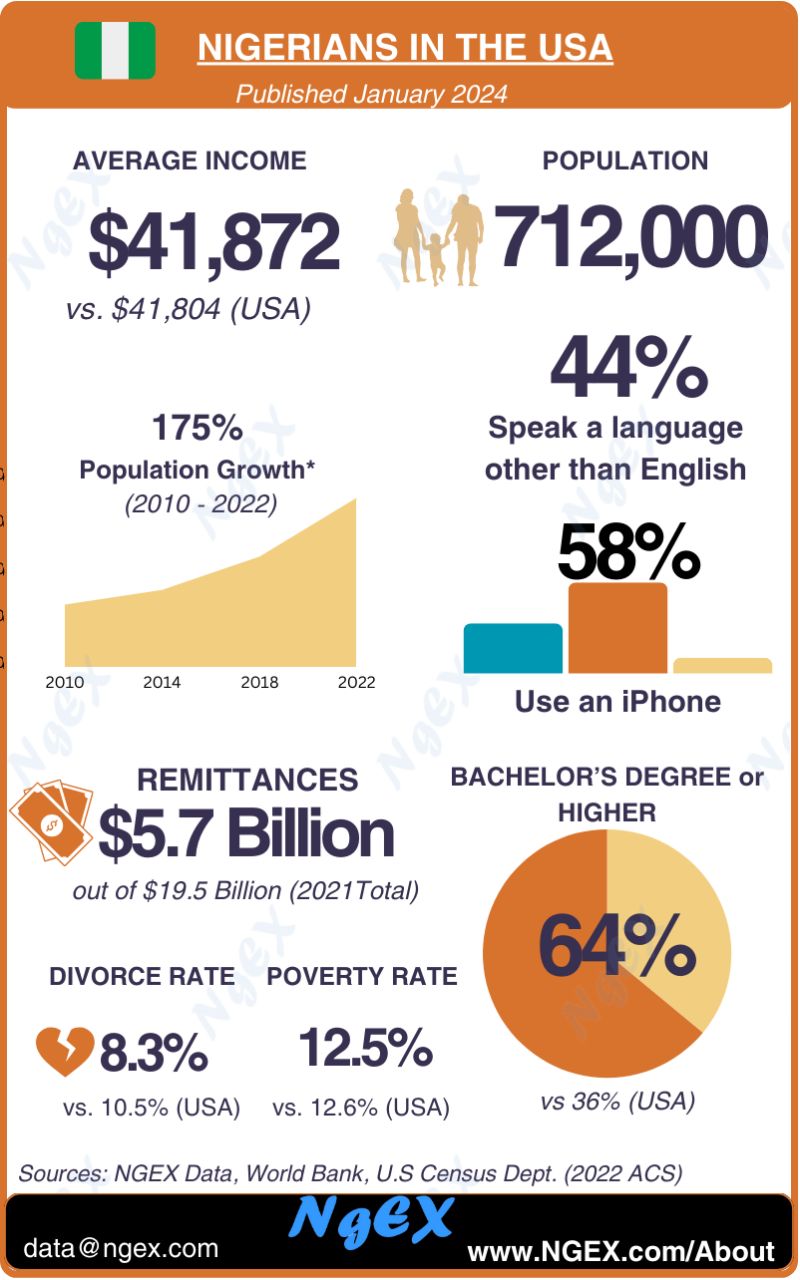

Highlight the diaspora’s contributions of over $20 billion in remittances annually, community-building, and cross-cultural innovation.

Promote Civic Education and Dialogue

- Utilize this crisis as a moment to educate host communities about the complex religious and social landscape in Nigeria. Host town halls, webinars, and run webinars, publish briefings and white papers and also empower diaspora youth and second-generation voices to participate in image-building and policy advocacy.

Final Thoughts and Recommendations

This moment is volatile and fraught, however it offers the opportunity for the Nigerian diaspora to step up and lead as powerful advocates. Nigerians in the USA are the largest black immigrant group in the USA but have not demonstrated significant advocacy for issues that are of concern to them.

The diaspora should use this crisis as an opportunity to educate host communities about the religious and social landscape in Nigeria. Host town halls, webinars, publish briefings and white papers and also empower diaspora youth and second-generation voices to participate in constructive image-building and policy advocacy.

By engaging more in advocacy, stressing for the provision of credible data, unity, persistent outreach and multifaceted engagement; the Nigerian diaspora can ensure that Nigeria’s story is told in the true light, and that host support is available for mutual benefit of the host countries and Nigeria.