Overview

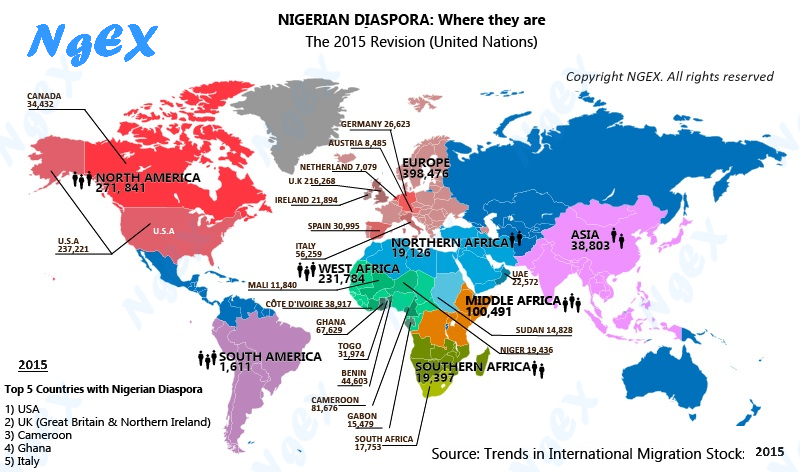

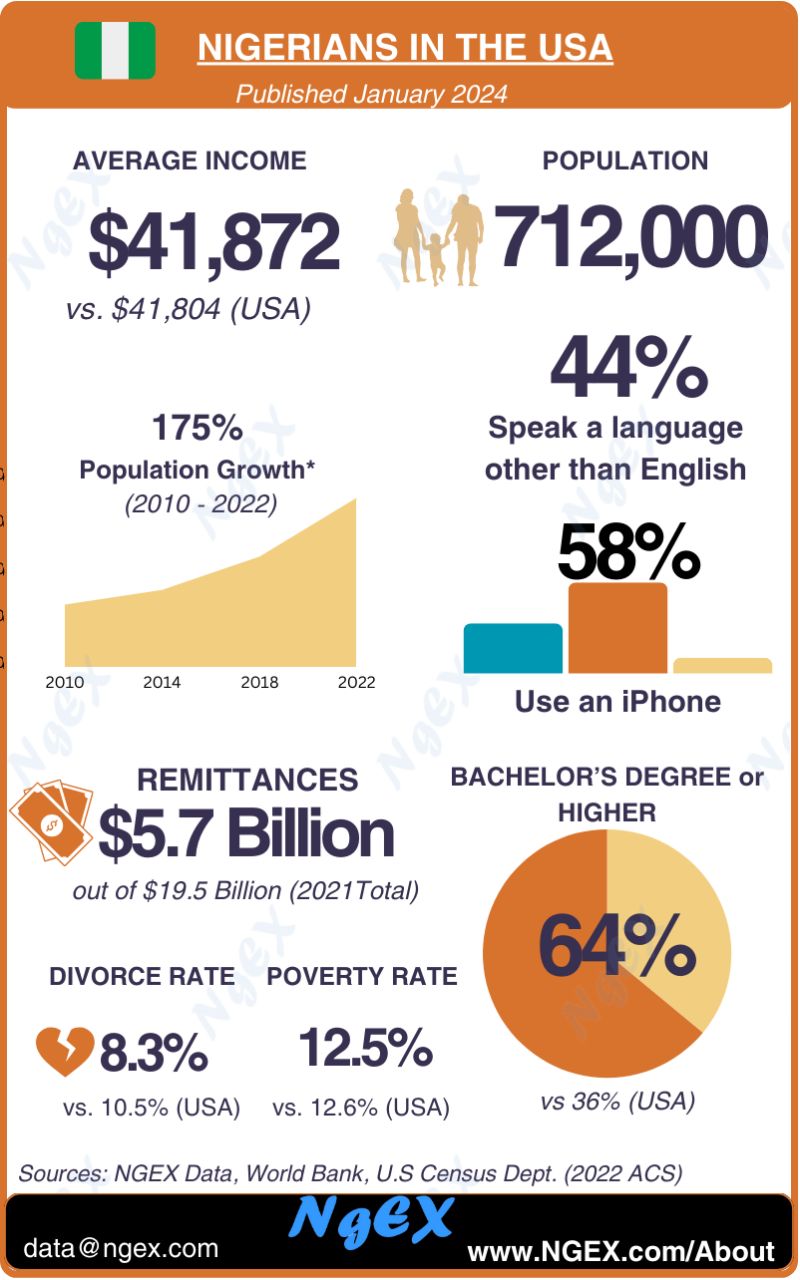

The Nigerian Tax Reforms, scheduled to begin in January 2026, represent the most comprehensive overhaul of the tax system since 1999, focusing on streamlining tax rates, expanding reliefs, and harmonizing fragmented tax laws. For members of the Nigerian diaspora, these changes bring significant clarifications regarding remittances, foreign-earned income, and investment, aiming to protect genuine support inflows and encourage engagement in national development.

The reforms introduce progressive tax rates, expand reliefs for low-income earners, and clarifies what is and isn’t taxable for Nigerians in the Diaspora.

Start Date

January 1, 2026

Critical Factors

183 day rule

Determines if all your income is taxed in Nigeria or not

The Big Picture: What’s Changing?

Starting January 2026, Nigeria is consolidating over a dozen fragmented tax laws into a streamlined system designed for transparency, fairness, and ease of compliance. The reforms introduce progressive tax rates, expand reliefs for low-income earners, and most importantly clarify for the diaspora what is and isn’t taxable .

Key changes for individuals include:

- Zero tax for annual incomes up to ₦800,000

- Progressive rates from 15% to 25% based on income brackets

- New rent relief capped at ₦500,000 or 20% of annual rent

- Raised exemption for job loss compensation from ₦10M to ₦50M

- Clear guidelines protecting genuine remittances from taxation

2026 Nigerian Tax Reform: Progressive Tax Rates by Income Bracket

The reforms roll out in phases throughout 2026, giving everyone time to understand and prepare.

1. The Good News: Your Foreign Income is Safe and NOT taxed.

The most important takeaway for non-resident Nigerians is this: The new tax laws do not tax your foreign earned income or remittances.

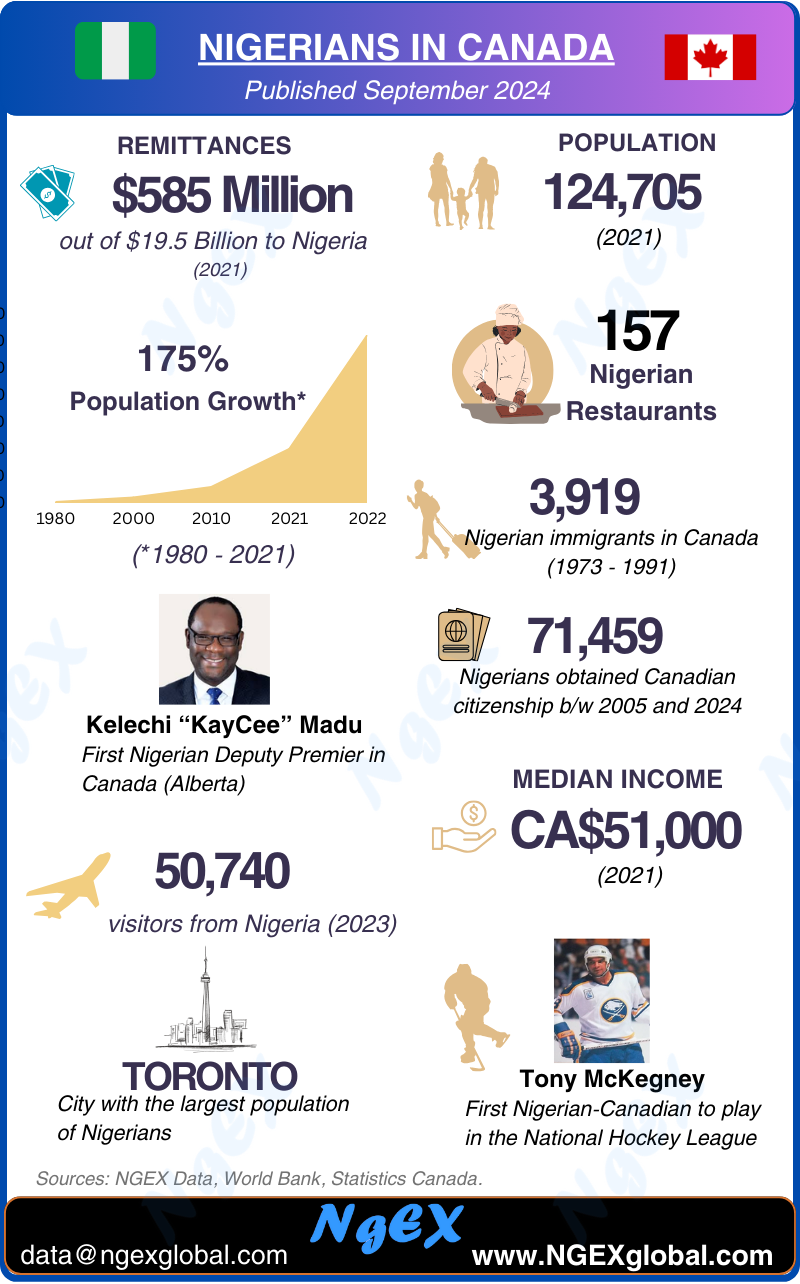

The core principle of the reform is that Tax Residency, not citizenship, determines your tax obligation in Nigeria. Taiwo Oyedele, Chairman of the PFPTRC, has repeatedly confirmed this: “Income earned abroad and brought into Nigeria by a non-resident individual is now specifically exempted from tax in Nigeria, regardless of the source or nature of the income. Diaspora remittances or investments are not subject to these new taxes.”

This explicit exemption removes a major source of ambiguity and is a significant win for diaspora confidence and investment.

What does get taxed? Income derived from Nigerian sources are taxed, such as business profits, rental income from properties you own, or returns on investments that you have in Nigeria. But even here, Double Taxation Agreements (DTAs) with most major countries protect you from being taxed twice on the same income.

Contact us with any Questions or Concerns

Get In Touch2. The Critical Factor: The 183-Day Rule

While your foreign income is exempt, your status as a Non-Resident Individual (NRI) is not automatic. It is determined by the 183-Day Rule.

Under the new law, you are considered a Nigerian Tax Resident (TRI) if you are physically present in Nigeria for 183 days or more (in aggregate) within any 12-month period. Crucially, this period includes all days of leave and temporary absence.

If you are present in Nigeria for 183 days or more, you are classified as a Tax Resident and become liable to pay tax, in Nigeria, on your Worldwide Income.

If you are present in Nigeria for less than 183 days, you are considered a Non-Resident Individual (NRI) and are not liable to pay tax on your Worldwide Income.

Who Needs to Pay Attention?

While people sending remittances can breathe easy, three diaspora profiles should pay closer attention:

- Diaspora Investors: If you own properties, stocks, or businesses in Nigeria generating income, you’ll need to report and pay taxes on those earnings according to the new progressive rates. The good news? Double Taxation Agreements (DTAs) mean if you’ve already paid tax abroad, you can get relief.

- Remote Workers: If you work remotely for international companies but your work is managed from Nigeria, you may be reclassified for tax purposes. Documentation becomes crucial here. So you should keep clear records of your employment status and income sources.

- Property Owners: Real estate investments remain attractive, but you’ll need to disclose properties and pay capital gains tax when applicable. The new guidelines aim to make this process more transparent and straightforward

Reporting Requirements

- Self-reporting is required for all individuals; guidelines will clarify taxable versus non-taxable inflows.

- Property owners must disclose real estate and capital gains for taxation at progressive rates.

- Remote workers who operate businesses abroad but are managed from Nigeria may be reclassified as Nigerian entities for tax purposes.

Who Needs to Pay Attention?

While people only sending remittances can breathe easy, three diaspora profiles should pay closer attention:

Diaspora Investors: If you own properties, stocks, or businesses in Nigeria generating income, you’ll need to report and pay taxes on those earnings according to the new progressive rates. The good news? DTAs mean if you’ve already paid tax abroad, you can get relief.

Remote Workers: If you work remotely for international companies but your work is managed from Nigeria, you may be reclassified for tax purposes. Documentation becomes crucial. So you should keep clear records of your employment status and income sources.

Property Owners: Real estate investments remain attractive, but you’ll need to disclose properties and pay capital gains tax when applicable. The new guidelines aim to make this process more transparent and straightforward.

Practical Steps for Compliance and Protection

To remain compliant and protect your financial interests under the new regime, follow these steps:

Assess Your Situation

- Determine if you have Nigerian-sourced income. If you’re only sending money home to family, you’re in the clear. If you own businesses or properties generating income, you should pay more attention to the new rules.

Track Your Travel Meticulously

- Action: Keep a meticulous record of all entry and exit dates to Nigeria.

- Why: This is your primary defense against being mistakenly classified as a Tax Resident. If your total stay approaches the 183-day limit, consult a tax professional immediately.

Document Your Funds Clearly

- Action: Maintain separate bank accounts for foreign and Nigerian income. When remitting funds, clearly label the purpose (e.g., “Family Support,” “Investment Capital”).

- Why: Clear documentation proves the source of your funds, supporting your claim for exemption as an NRI.

Verify Withholding Tax (WHT) Credit:

- Ensure that companies paying dividends or interest in Nigeria provide proper documentation for the WHT they deduct, as this may count as your final tax.

Leverage Double Taxation Agreements (DTAs)

- Nigeria has DTAs with over a dozen countries, including Canada, China, France, the Netherlands, South Africa, and Spain.

- If you have Nigerian-sourced income (e.g., rental income), a DTA allows you to claim a tax credit in your country of residence for the tax paid in Nigeria, preventing the same income from being taxed twice.

Consult the Right Experts

- Seek advice from an international tax specialist familiar with both Nigerian tax law and the laws of your country of residence.

Register and Stay Informed

- Nigerian-Sourced Income: If you derive income from Nigeria, you must register for a Tax Identification Number (TIN) and ensure all withholding taxes are properly remitted.

- Digital Platforms: Monitor the official website of the PFPTRC (fiscalreforms.ng) and the Federal Inland Revenue Service (FIRS) for official circulars and digital compliance tools

- Join diaspora-focused forums, subscribe to newsletters and updates from Diaspora focused organizations like NGEX, attend webinars and listen to podcasts that explain the tax reforms

Nigeria’s 2026 tax reforms protect genuine remittances, and encourage meaningful engagement. Some in the Diaspora will face new reporting requirements, but most diaspora Nigerians will continue supporting family and community exactly as before, with zero tax implications.

The key is staying informed, documenting properly, and seeking guidance when needed. Your contributions to Nigeria’s economy and your loved ones’ well-being remain valued and protected.

Disclaimer

This post is for informational purposes only and does not constitute legal or financial advice. All hypothetical scenarios and any estimated financial impacts are for illustrative purposes only. You should consult with a qualified tax professional to assess your specific tax obligations.